Sign up for the Slatest to get the most insightful analysis, criticism, and advice out there, delivered to your inbox daily.

On Wednesday at 12:01 a.m. EDT, the Donald Trump administration’s huge, newly announced tariffs on most of the world’s countries and penguin islands officially went into effect. The purpose of these tariffs, according to certain members of the administration, was to rebuild the golden age of American manufacturing, on the logic that if everything else in the world becomes unbelievably expensive, the U.S. will have no choice but to build stuff here. “The army of millions and millions of human beings screwing in little, little screws to make iPhones, that kind of thing is going to come to America,” Secretary of Commerce Howard Lutnick said on Face the Nation. Sounds fun!

Fox News was on board, with host Jesse Watters arguing to great viral effect that the duties would force American men out of soft-handed baby professions like News Blogger and back into more masculine ones like, we guess, Lumber Man. (It is the opinion of this news blogger that those outraged about Watters’ statements often fail to understand that he is making them mostly as a joke in the first place, which is not to excuse the more genuinely abhorrent things he also says, but we digress.)

Other members of the administration, though—like Secretary of the Treasury Scott Bessent—were pushing publicly and privately for Trump to segue from Threat Mode into negotiations that would allow him to dial down the promised tariff rates (e.g., extract an agreement with Country X to lower its tariffs against U.S. goods by a few percent, declare victory, go home). Bessent, like many of his former peers on Wall Street, seemed a bit concerned that sudden and massive increases in the costs of goods in the world’s largest economy would, you know, be bad for the world economy. Markets agreed: U.S. stock indices fell roughly 10 percent in the week of the April 2 announcement of the worldwide tariffs. At the same time, the price of U.S. Treasury bonds was also dropping, which suggested among other things that investors globally were starting to get a little worried about the country’s long-term ability to make good on its promises to pay back loans.

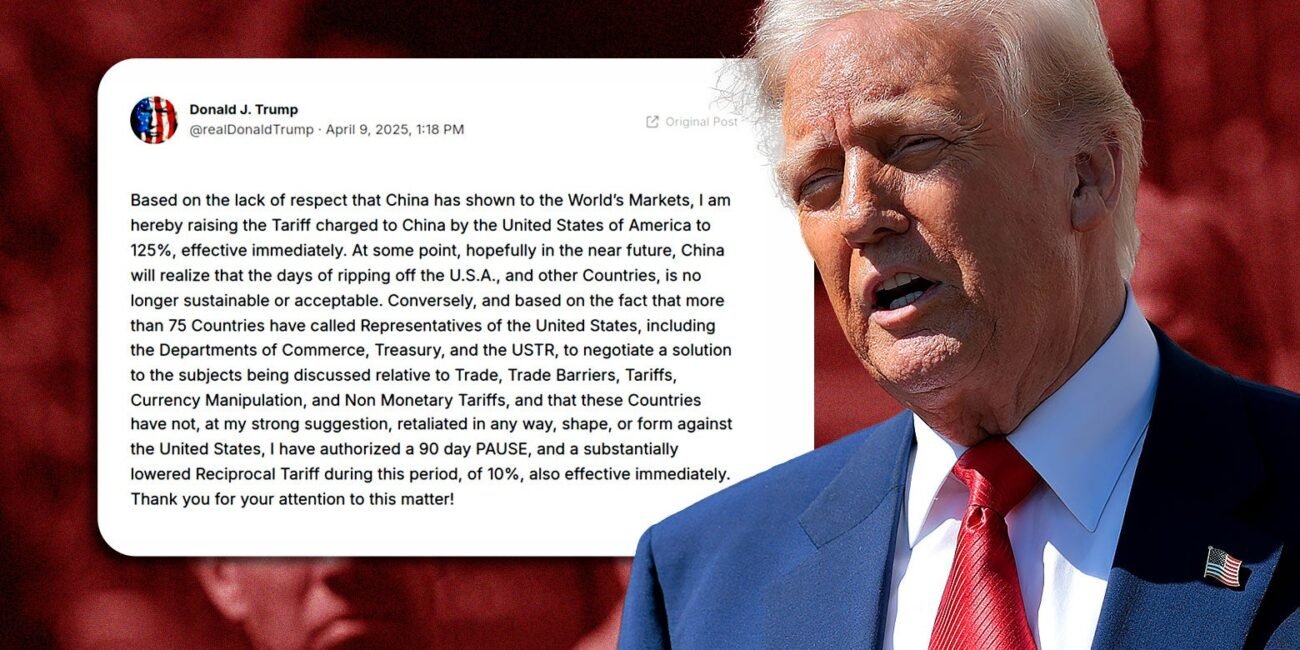

With all this going on, Trump announced at 1:18 p.m. on his Truth Social platform that he would be instituting a “90-day pause” on some but not all of the tariffs on, apparently, any country that had been in contact with the U.S. about potential negotiations:

Based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.

The markets reacted with glee and relief, making back some (if not all) of their recent losses. White House press secretary Karoline Leavitt told members of the media assembled for a press conference with Lutnick and Bessent that they had witnessed “the art of the deal,” the absence of any actual deals notwithstanding. The vibes were celebratory!

The reality, though, is still concerning, from the standpoint of potential economic catastrophe. For one, Trump simultaneously announced that the U.S.’s tariff on Chinese goods, in retaliation for China’s own retaliation, has been increased to 125 percent. Twenty-five percent tariffs on many goods from Canada and Mexico are still in effect as well; China, Mexico, and Canada are, by a considerable margin, the largest exporters of goods to the United States. Previously announced tariffs that only apply to automobiles, steel, and aluminum, per the administration, will also still be enforced. And Bessent further confirmed that new tariffs are still in the works for pharmaceuticals and lumber.

Nor did officials’ handling of the announcement convey the kind of coherence and finality that businesses might be looking for in order to make decisions involving projected costs and revenues. Bessent and a White House spokesperson, for instance, both told reporters that the 10 percent baseline tariff alluded to in Trump’s tweet would be applied on top of the 25 percent tariffs imposed on Canada and Mexico, only for another administration official to later say that it will not. Shortly after Bessent said that the pause had been planned “all along” rather than being a reaction to the bond market, Trump said it had been a reaction to the bond market. And in the Oval Office late in the afternoon, the president seemed to be learning in real time, via a conversation with Lutnick and the reporters present, about retaliatory measures announced by the European Union earlier in the day.

Long story short, inflation is still on the menu, and the details of world-shaking decisions are being decided on the fly, sometimes after they’ve been announced. Good luck to everyone who committed $100 million to an iPhone screw factory this weekend!

No Comment! Be the first one.